What kind of loans do we offer?

We have two different types of loans at Cash Converters – a loan against your quality second-hand items of value or your salary. These loans are safe, secure and convenient for anyone looking for instant cash, without going the traditional microlending route. For a more detailed loan breakdown click here.

Cash Advance

A 1-month loan against the things you own. Bring us your items (such as phones, electronics, appliances, jewellery and more) and we’ll process an instant cash loan.

Payday Loan

A 1-month loan against your salary and payable on your next salary run. Get a loan of R400 – R4 000.

Visit your nearest CashiesTM Store

Whether you're looking for a loan, selling your pre-loved goods or buying quality second-hand items, visit a Cashies™ store near you.

How much does a loan cost?

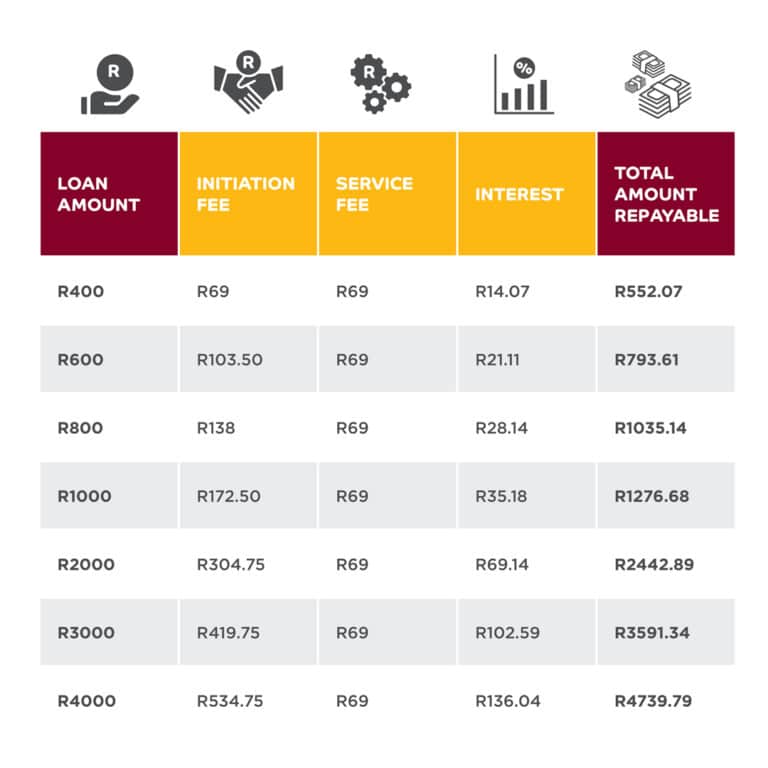

This is an indicative schedule of loan costs for a 30 day loan.

*Ts and Cs apply

How does a Cash Converters loan work?

For a detailed loan breakdown, click here. The interest on our loans varies according to the amount you borrow.

All fees are in accordance with the National Credit Act:

- The loan costs for our Cash Advance and Payday loans are the same.

- Loan costs may vary depending on the date the loan was taken out.

- We comply with the National Credit Act.

- Both our Cash Advance and Payday loans are short-term (1-month) loans, so the ‘total amount repayable’ must be paid back to us at the end of 30 days.

Why take a loan with us?

Our cash loans are both 1-month loans ― perfect for people who need immediate cash but don’t want to fill in endless paperwork. We are a reputable microlender that will help when life happens.

All our stores are registered National Credit Providers, and our loans comply with the National Credit Act.

All our loans are concluded in-store.

Our friendly consultants help you with every step in the process.

We don’t pay loans into a bank account. Our Cashies™ Card is a Visa card, linked to FNB, and works just like a debit card.

This will help you to understand your financial situation and empower you to know your status and build off where you are now.

Click here for our fee disclosure

Every Cash Converters store is a registered credit provider with the National Credit Regulator. Fees are charged as per regulations to the National Credit Act, no. 34 of 2005, for short term credit transactions. An initiation fee of R165 excluding 15% VAT per credit agreement is charged plus 10% of the amount in excess of R1 000 advanced, but never to exceed R1 050 excluding 15% VAT and shall never be greater than 15% of the credit advanced. Interest is charged at 5% per month on the first loan, and 3% per month on subsequent loans within a calendar year. The monthly service fee of R60 excludes 15% VAT and is pro-rated for the first month.

What this means for you: We comply with the National Credit Act, so everything is ethical, legal and above board. Every time you buy something on credit, we charge an initiation fee, interest and a monthly service fee, but these amounts are fair and within set limits.